avalara tax jurisdiction codes

Enter the rule information on the. Find the Avalara Tax Codes also called a goods and services type for what you sell.

Avalara Avatax Sales Tax Automation Product Evaluation Business 2 Community

A special tax jurisdiction is a jurisdiction which is not possible to categorize as a State Province City or County jurisdiction typically they jurisdictions which cover a geographic area which is.

. Select the states in which you do business. In AvaTax go to Settings All AvaTax Settings. On the Where You Collect Tax page during the Avalara guided onboarding experience double-check where your company is registered to collect and pay tax.

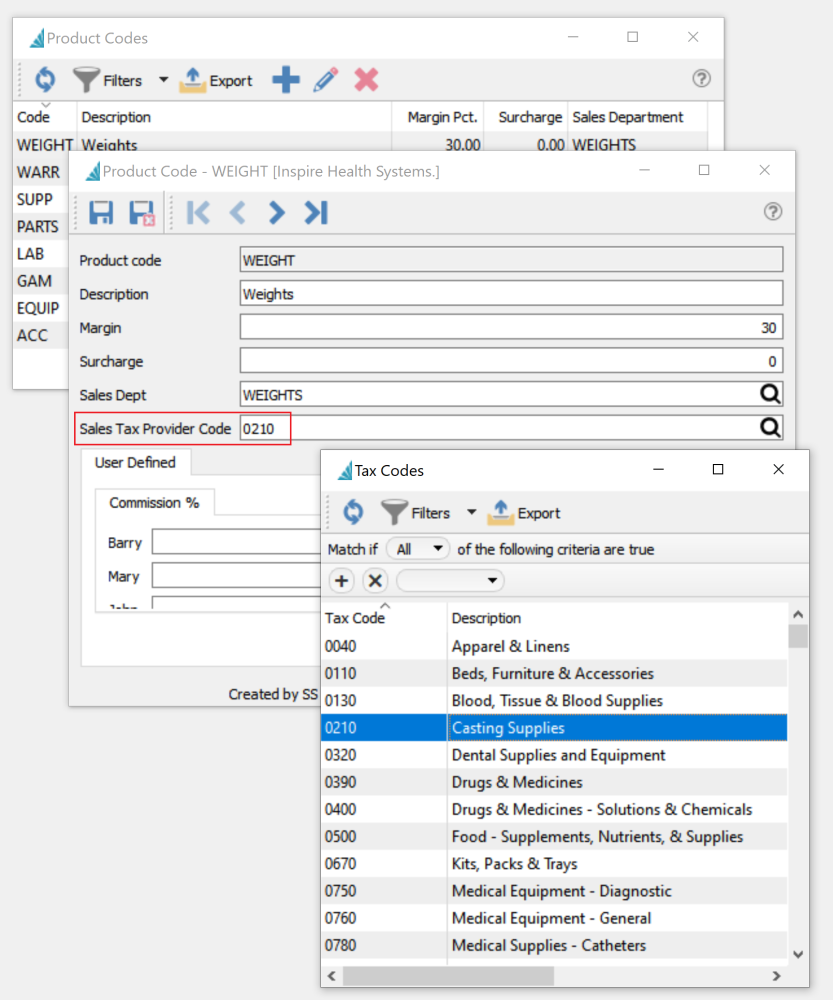

Returns preparation filing and remittance. The most common place to map an item to a tax code is the place where you maintain your master inventory list which is typically in your business application. We publish tables based on our latest.

Sales and use tax determination and exemption certificate management. This means businesses that make over 100000 in total gross sales or. If you are getting a gettax result for a jurisdiction that you have not identified in the Avalara Nexus settings regardless of the item or tax code passed the result.

Adjustment for excluded charges - india. Its important to note that there is a maximum of 100000 items per import. The 2018 United States Supreme Court decision in South Dakota v.

Tax rates are incredibly difficult to track at scale. Sales and use tax determination and exemption certificate management. Apply more accurate rates to sales tax returns.

Alone has more than 13000 sales and use tax jurisdictions. Temporary unmapped digital goods sku - taxable default. What is the sales tax rate for the 75001 ZIP Code.

Retailer should refer to jurisdiction definition for qualified items covered by this code. Get information about sales tax and how it impacts your existing business processes. There are more than 13000 sales and use tax jurisdictions in the United States alone and each one is subject to ongoing rate and taxability.

P0000000 and U0000000 are generic codes that are used when you have items that arent mapped to an Avalara tax code. Find the average local tax rate in your area down to the ZIP code. Quickly learn licenses that your business needs and.

Avalara tax codes are our way of. Temporary unmapped digital goods sku - taxable default. The estimated 2022 sales tax rate for 75001 is.

The taxpayer group is a dropdown in taxpayer preferences that lets you sort tax sessions by elements they have in common. Item Classification can be time-consuming and different for each jurisdiction. You can use this search page to find the Avalara codes that determine the taxability of the goods and services you sell.

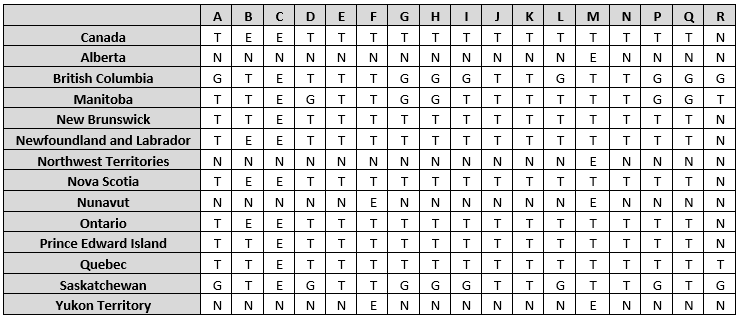

Use the taxability matrix to view the taxability information on items for each jurisdiction in which you sell. The outbreak of COVID. Puerto Rico has joined Washington DC parts of Alaska and 45 states in adopting economic nexus laws.

Marketplace facilitator tax laws. AvaTax delivers real-time sales tax rates and uses advanced technology to map rates to exact address locations based on the latest jurisdiction requirements. Select Tax Rules and then select Add a Tax Rule.

You can copy and paste a code you find here into the Tax Codes field in. If you must map more than 100000 SKU codes to. Same of nexus and tax rules.

Marketplace facilitator tax laws. Example of using custom common codes. Returns preparation filing and remittance.

Next to Custom Rules select Manage. These tax codes are taxed at the full. TaxCode the Avalara Product Tax code for the variant.

Adjustment for excluded charges - india. Choose to either download the full taxability matrix which.

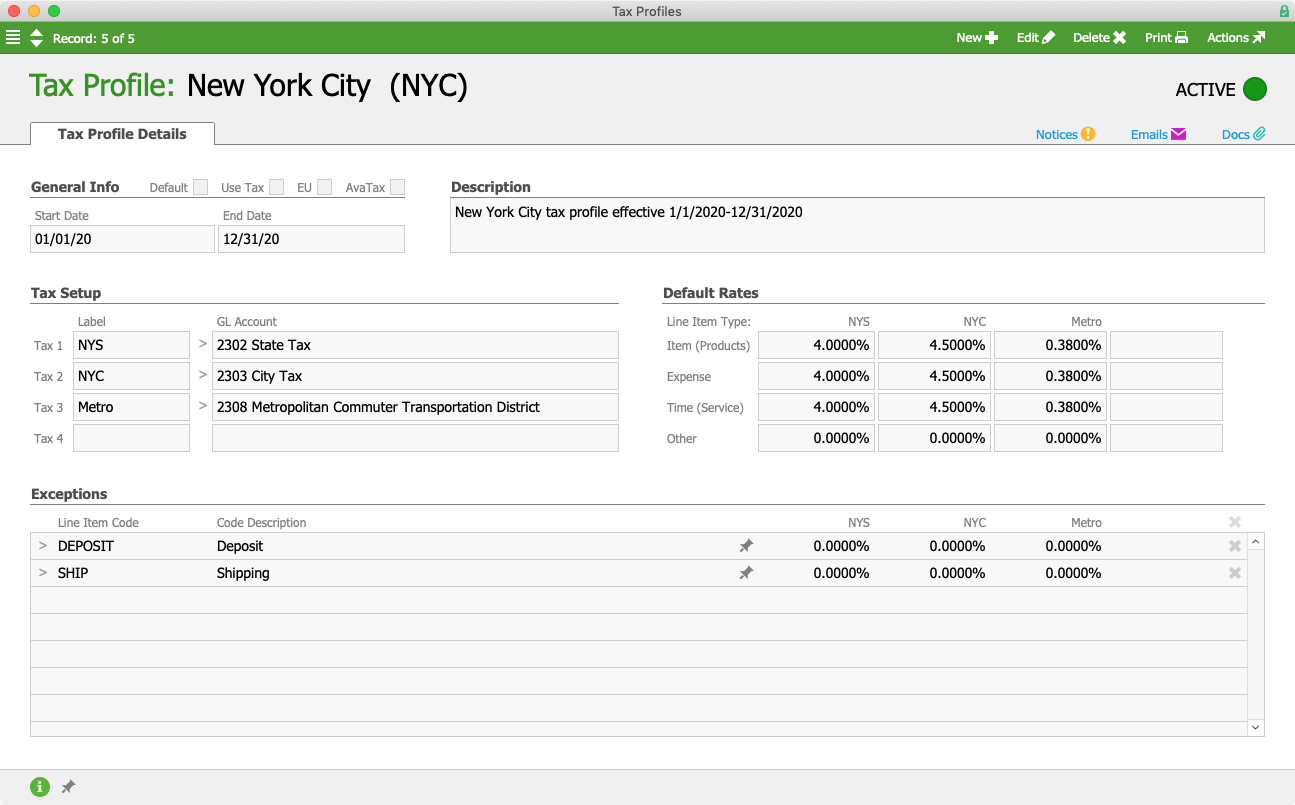

Setting Up Sales And Use Tax In Microsoft Dynamics 365 Business Central

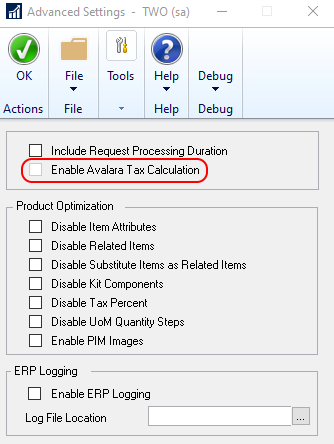

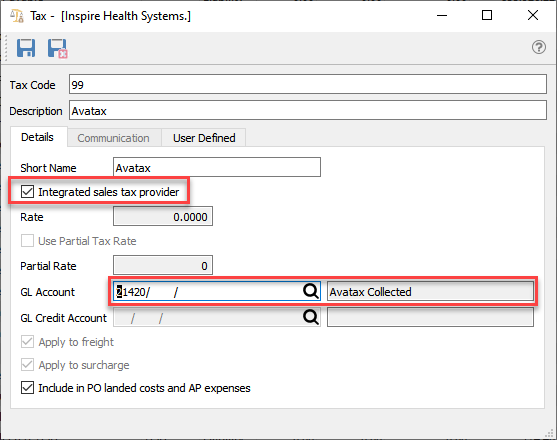

Avalara Sales Tax Spire User Manual 3 5

Avalara Sales Tax Spire User Manual 3 5

Avalara Sales Tax Automation Integration With Inform Erp Ddi System

Avalara Configuration In Sap Business Bydesign Sap Blogs

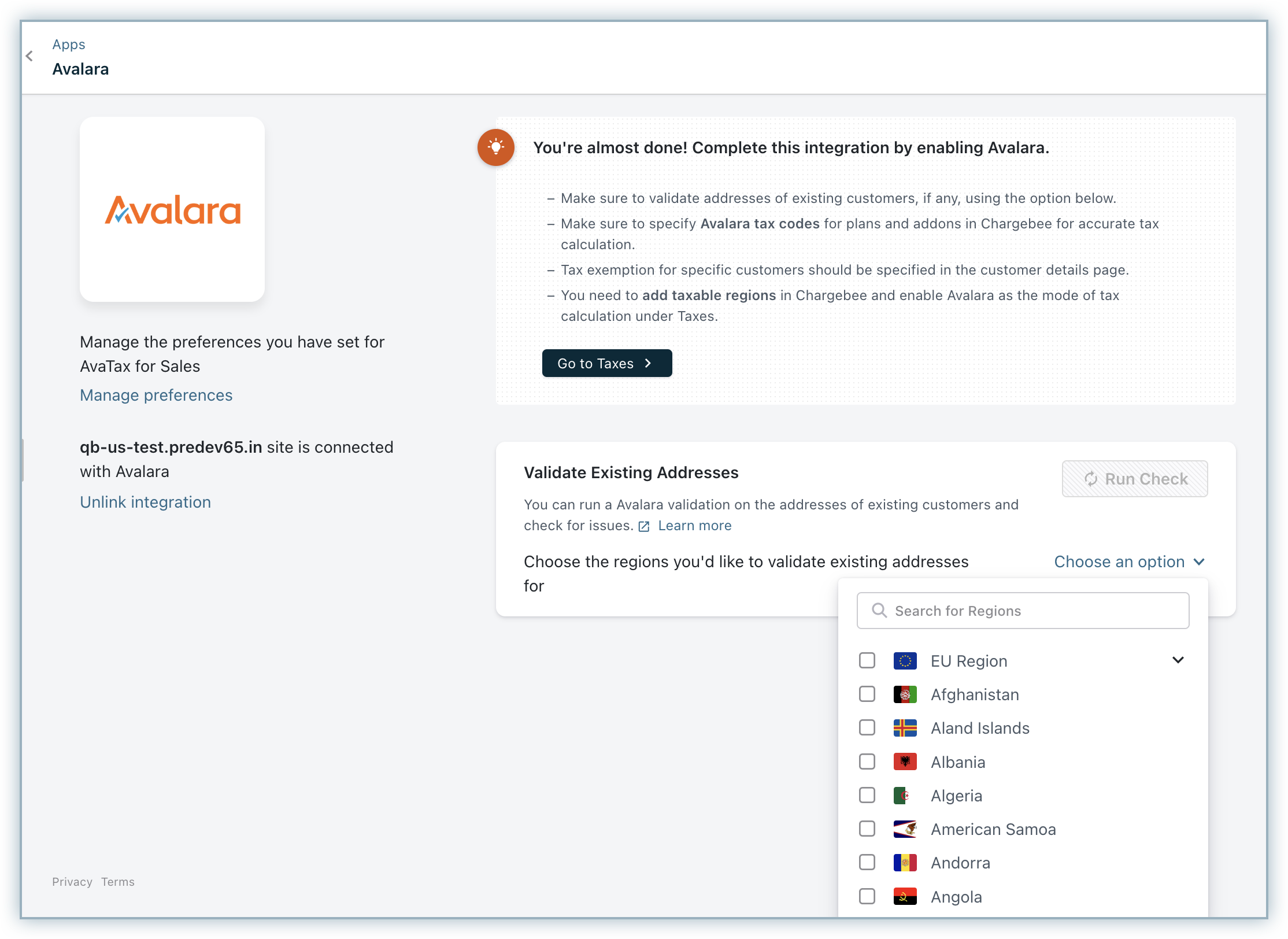

Avatax For Sales Chargebee Docs

Subscription Software Integration With Avalara Subscriptionflow

Easily And Accurately Collect Sales Taxes With Aace Avalara Avatax Aacesoft Business Management Software

Product Update 393 Sales Tax Integrated With Avalara American And Canadian Legislations

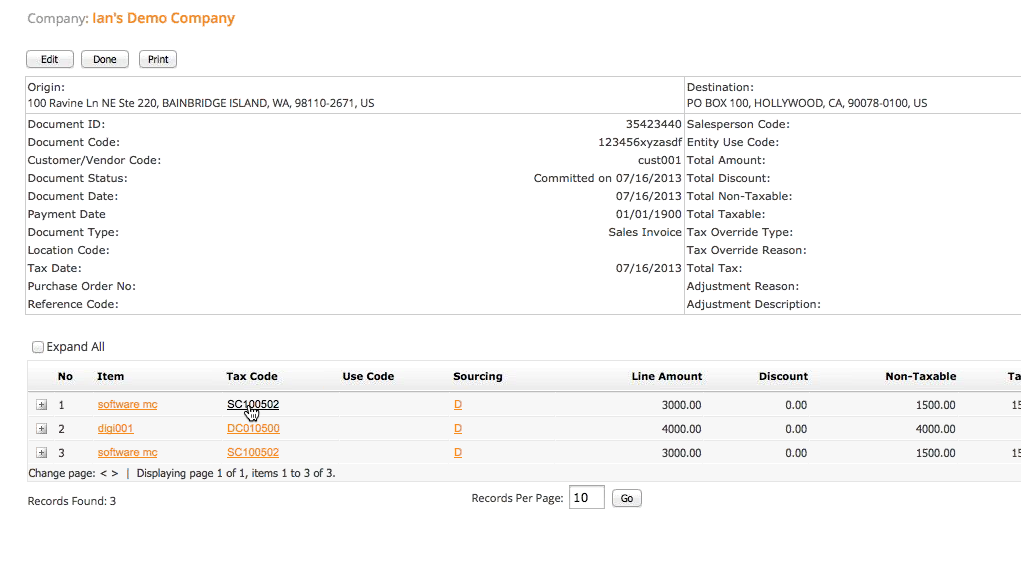

Map The Items You Sell To Avalara Tax Codes Avalara Help Center

Avalara Automating Sales Tax Compliance With Avalara Youtube

Avalara Avatax Set A Customer To Be Tax Exempt In U S And Canada

Sales And Use Tax Compliance Management Passport Software

Map Item To Avalara Tax Code Avatax Youtube